AAA administers two state-approved Florida scholarship programs for children with no eligible disabilities: (1) the Florida Tax Credit Scholarship (“FTC”) and (2) the Family Empowerment Scholarship for Educational Options (“FES-EO”). The same application is used to apply for both scholarships.

As directed by the state of Florida and in an effort to maximize the use of tax credit revenue, students who are eligible for both FTC and FES-EO scholarships will be awarded FTC scholarships until FTC funding is exhausted.

2026-27 School Year – Private School Scholarship Applications

Applications for Florida scholarships for the 2026-2027 school year opened on Sunday, February 1, 2026.

Renewal priority applicants:

1) AAA sent an email to all renewing families the instructions on how to re-apply with us starting at 9 am on Sunday, February 1, 2026. All renewing families must use the invitation that AAA emailed to you to apply. Check your junk folder in your email system if our email in not in your inbox. Contact us if you need us to resend your invitation.

2) The deadline to submit your Renewal Priority application is Thursday, April 30, 2026.*

3) Once awarded, Renewal Priority applicants must Accept or Decline their student’s renewal priority scholarship award by Sunday, May 31, 2026 to retain that priority.

4) Private school scholarship applications submitted by Renewing Priority applicants after the April 30th deadline will be processed as new applicants (see information below).

Renewal non-priority applicants:

1) Private school scholarship applications submitted by renewing applicants after the April 30th deadline will be processed as new applicants (see information below).

2) All renewing families must use the invitation that AAA emailed to you to apply. Contact AAA if you need us to resend your invitation.

New private school applicants:

1) Beginning at 9 am on Sunday, February 1, 2026, new applicants may click here to begin the application process.

2) Applications submitted before that time will not be processed and will need to be resubmitted.

3) The deadline to submit your new scholarship application is Sunday, November 15, 2026.*

4) Once awarded, you will need to Accept or Decline your student’s new scholarship award by Tuesday, December 15, 2026.

Transferring from SUFS? Welcome! We’re glad you’re here! Current SUFS students transferring to AAA will retain their renewal status. Transferring students will apply as “New” and the state will notify us which student statuses need to be moved to “Renewal.” Please see the “New private school applicants” section above for important dates and deadlines.

Have you already submitted your application? Click here to check the status.

Need to log back into the SMP? Click here to log back in

Need more help applying? Watch our helpful tutorial videos.

Important Reminder: Renewing applicants using their scholarship at private schools are required to upload proof of enrollment with each student application. Proof of enrollment must be on school letterhead and include all of the following: 1) The name of the school, 2) the student’s full name, 3) the grade level the student will be entering, and 4) the enrollment date (including academic year).

*By law, students in foster care** or out-of-home care*** and dependent children of active-duty members of the United States Armed Forces**** may apply at any time for a scholarship, however, that does not mean that funding is guaranteed. If the link to the application is not available above, please contact us by using our Contact Us page or by leaving us a message at 888-707-2465 so that we may provide you with it directly.

**“Foster care” means care provided a child in a foster family or boarding home, group home, agency boarding home, child care institution, or any combination thereof, as defined by s. 39.01(29).

***“Out-of-home” means a placement outside of the home of the parents or a parent, as defined by s. 39.01(55) which is further defined as the placement of a child in licensed and non-licensed settings, arranged and supervised by the department or contracted service provider, outside of the home of the parent, as defined by DCF Rule 65C-30.001 Definitions (82).

****Active-duty members of the United States Armed Forces who do not have a Florida residential address at the time of application but have received Permanent Change of Station orders must 1) provide a copy of their orders with their application and 2) list the Florida address of the unit to which they are being assigned.

Scholarship Management Platform (“SMP”)

Our secure, online SMP is where you will apply for AAA scholarships and then manage your student’s scholarship account.

Here is a link to log back into the SMP after accepting the AAA’s invitation: Login – AAA Scholarships

FAQ #1: When I try to log into the SMP, I get an error message that the account is disabled or that the email or password doesn’t match. What am I doing wrong?

ANSWER #1: All returning users must create a new SMP account and password for the 2025-2026 school year. To ensure you have access to all the new features and improvements, it is essential that you set up a new account, even if you used the previous system. Please follow the instructions on the email you received to create your new SMP account and get started.

FAQ #2: I received an email to log into the SMP for a new message about my scholarship. Where do I find the message?

ANSWER #2: Messages can be found in the top right corner of your SMP account once you’ve logged in:

FAQ #3: I have received and accepted my student’s 2025-26 award. What is the next step?

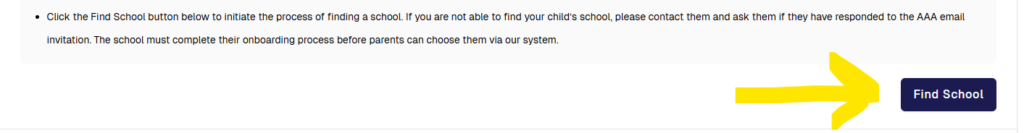

ANSWER #3: Once your student has been found eligible for the 2025-26 school year, you will receive an email notifying you that a determination had been made. The next step will be the School Commitment Form (“SCF”) process by clicking on the Find School button, then searching for and selecting your school:

Have more questions about the SMP? Please visit our helpful SMP FAQ page.

Have more questions about the SMP? Please visit our helpful SMP FAQ page.

Already submitted your 25-26 school year application? Click here to check the status.

If you still need help after that, please leave us a message at 888-707-2465 so we can call you back or send us a message on the Contact Us page of our website.

3 easy steps for using your AAA scholarship for private school

Step 1. Application Submission – Applicants must first submit their scholarship applications to AAA by the designated deadline and be found eligible.

Step 2. School Commitment Form (SCF) – Both the parent and school must confirm the student’s enrollment by submitting SCFs to AAA.

Step 3. Scholarship Payments – Both the school and parent will complete an online Verification Report (VR) to verify continued enrollment and attendance before each scholarship payment may be released. See the scholarship payment calendar at the bottom of this webpage for important dates.

Have a question? Please let us know on the Contact Us page of our website or leave us at message at 888-707-2465 so we can call you back.

More Helpful Information:

Here is everything you need to know about applying for an income-based scholarship

PEP/FTC – Purchasing Handbook for 2025-2026

FTC and FES-EO Frequently Asked Questions (FAQs) – coming soon!

FTC – Maximum Scholarship Award Values for 2025-2026 – scroll to bottom of page for more information

FTC/FES-EO/PEP Parent and School Handbook

Florida Foster / Out-of-Home Care Flyer

Collection and Use of Social Security Numbers

Visit IRS Get Transcript Website for copies of Income Tax Returns or W-2 Information

Link to order a copy of a Florida birth certificate: Birth | Florida Department of Health (floridahealth.gov)

Video Tutorials for AAA Scholarship applicants

Need help locating a school near you? Try out our School Finder Map, visit GreatSchools.org, or our Private School Navigator may be able to help

FL Department of Education Private School Directory

File a complaint with the FL Department of Education about a school

Still have questions? Click on our Contact Us webpage to let us know or leave us a message at 888-707-2465.