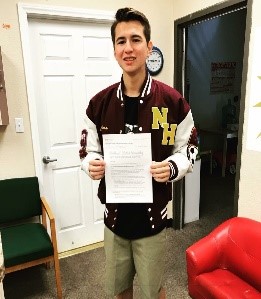

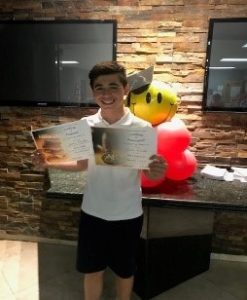

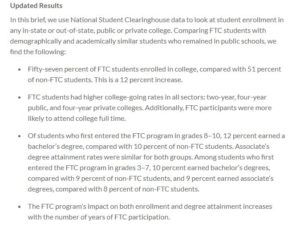

An update to the 2017 Urban Institute study of The Effects of the Florida Tax Credit Scholarship Program on College Enrollment and Graduation by Matthew Chingos, Tomas Monarrez, Daniel Kuehn has been released and the results are conclusive: “…students who enroll in private school through the [Florida Tax Credit] program are more likely to go to and graduate from college than their public school peers.”

The update also confirmed their earlier findings that the longer a student participates in the program, the higher the likelihood that they will attend a four-year college and earn a bachelors degree when compared to their public school counterparts. The studies are unique in that the public school comparison samples were made up of students who attended the same public schools as the scholarship students (before their participation) – making the results robust.

The update also confirmed their earlier findings that the longer a student participates in the program, the higher the likelihood that they will attend a four-year college and earn a bachelors degree when compared to their public school counterparts. The studies are unique in that the public school comparison samples were made up of students who attended the same public schools as the scholarship students (before their participation) – making the results robust.

AAA Scholarship Foundation is proud to be one of only two administrators of the Florida Tax Credit Scholarship Program. To find out more about AAA or any of the six scholarship programs we administer, visit us at www.aaascholarships.org.